All Categories

Featured

Table of Contents

nfinite banking is a financial strategy that empowers you to take control of your finances using the cash value of a whole life insurance policy. By becoming your own banker, you can leverage the cash value to fund large expenses, invest in business opportunities, or handle emergencies—all while your money continues to grow tax-free. For business owners, infinite banking is an invaluable tool for maintaining financial independence and flexibility.

Whole life insurance policies designed for infinite banking offer stability and predictability, ensuring steady cash value growth over time. whole life insurance for cash value growth brokers. Policies with living benefits further enhance their appeal, offering access to funds for critical illnesses or other urgent needs. Whether you’re looking to finance major purchases, grow your business, or achieve financial independence, infinite banking adapts to your goals while providing long-term security

This concept is especially beneficial for individuals and families seeking flexible financial solutions or business owners aiming to optimize their cash flow. Learn more about how infinite banking can transform your financial future. Schedule a free consultation today and take the first step toward achieving complete financial control.

It permits you to budget plan and strategy for the future. You can conveniently factor your life insurance policy into your spending plan because the costs never transform. You can prepare for the future equally as easily because you know specifically just how much money your loved ones will obtain in case of your absence.

In these cases, you'll normally have to go through a new application process to get a much better price. If you still need protection by the time your degree term life plan nears the expiration date, you have a few choices.

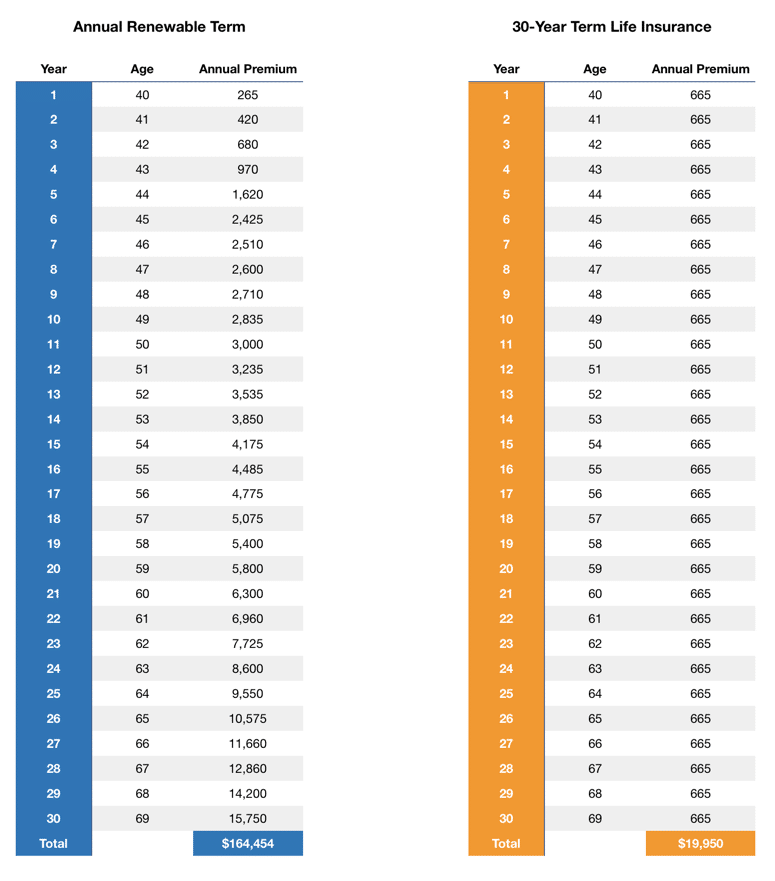

A lot of degree term life insurance policy plans feature the alternative to restore insurance coverage on a yearly basis after the initial term ends. what is level term life insurance. The cost of your plan will be based upon your existing age and it'll boost every year. This might be a great choice if you just need to prolong your protection for one or 2 years or else, it can obtain pricey quite rapidly

Degree term life insurance is among the least expensive insurance coverage choices on the market since it provides fundamental protection in the type of fatality advantage and only lasts for a collection amount of time. At the end of the term, it ends. Entire life insurance, on the various other hand, is considerably much more pricey than degree term life because it doesn't run out and includes a cash money worth function.

Best What Is Decreasing Term Life Insurance

Prices might differ by insurer, term, protection quantity, health class, and state. Level term is a fantastic life insurance policy alternative for many individuals, yet depending on your insurance coverage demands and individual situation, it could not be the ideal fit for you.

Annual renewable term life insurance has a term of only one year and can be restored every year. Yearly sustainable term life premiums are initially reduced than degree term life premiums, but rates rise each time you restore. This can be a good alternative if you, for example, have just stop smoking and require to wait 2 or 3 years to look for a level term policy and be eligible for a lower price.

Honest Term Vs Universal Life Insurance

, your death benefit payment will certainly lower over time, however your payments will remain the exact same. On the various other hand, you'll pay even more in advance for much less protection with a boosting term life plan than with a level term life policy. If you're not sure which type of plan is best for you, working with an independent broker can assist.

As soon as you've made a decision that level term is best for you, the following step is to buy your plan. Right here's exactly how to do it. Compute how much life insurance policy you need Your coverage amount ought to give for your family members's long-lasting monetary requirements, including the loss of your earnings in case of your death, along with financial debts and daily costs.

A level premium term life insurance policy plan lets you adhere to your spending plan while you help protect your family members. Unlike some stepped price plans that boosts annually with your age, this type of term strategy supplies prices that remain the very same for the duration you pick, even as you grow older or your health changes.

Discover more about the Life insurance policy options offered to you as an AICPA participant. ___ Aon Insurance Coverage Services is the trademark name for the brokerage firm and program management operations of Fondness Insurance policy Services, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Policy Firm, Inc. (CA 0795465); in Okay, AIS Affinity Insurance Policy Providers Inc.; in CA, Aon Fondness Insurance Coverage Providers, Inc.

A Renewable Term Life Insurance Policy Can Be Renewed

The Strategy Representative of the AICPA Insurance Trust, Aon Insurance Providers, is not connected with Prudential. Team Insurance protection is issued by The Prudential Insurer of America, a Prudential Financial business, Newark, NJ. 1043476-00002-00.

Latest Posts

Burial Insurance For Seniors Over 60

Out Insurance Funeral Cover

Best Burial Insurance For Seniors Over 70