All Categories

Featured

Table of Contents

It enables you to spending plan and prepare for the future. You can easily factor your life insurance policy right into your spending plan because the premiums never alter. You can plan for the future equally as conveniently because you know specifically just how much money your liked ones will certainly obtain in the occasion of your lack.

This is true for people who stopped smoking cigarettes or that have a wellness problem that resolves. In these instances, you'll normally have to go through a brand-new application process to obtain a better price. If you still require insurance coverage by the time your level term life policy nears the expiry date, you have a few alternatives.

A lot of level term life insurance policies feature the option to renew protection on a yearly basis after the initial term ends. what is level term life insurance. The cost of your plan will certainly be based upon your current age and it'll raise yearly. This can be a great alternative if you just need to prolong your protection for one or 2 years or else, it can obtain pricey pretty rapidly

Level term life insurance policy is just one of the most inexpensive protection options on the marketplace because it supplies fundamental defense in the kind of fatality advantage and only lasts for a set time period. At the end of the term, it ends. Whole life insurance policy, on the various other hand, is dramatically a lot more costly than degree term life due to the fact that it doesn't end and features a cash worth attribute.

Cost-Effective Does Term Life Insurance Cover Accidental Death

Rates may differ by insurance firm, term, coverage quantity, health class, and state. Level term is a fantastic life insurance option for the majority of people, however depending on your coverage demands and personal circumstance, it may not be the finest fit for you.

This can be an excellent alternative if you, for example, have simply stop smoking and require to wait 2 or 3 years to apply for a level term policy and be qualified for a reduced price.

Which Of These Is Not An Advantage Of Term Life Insurance

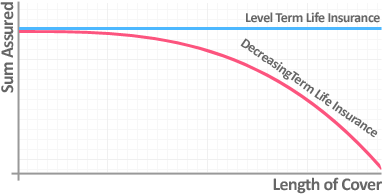

, your death benefit payout will certainly lower over time, however your settlements will certainly remain the exact same. On the other hand, you'll pay even more upfront for less insurance coverage with an enhancing term life policy than with a level term life plan. If you're not certain which type of plan is best for you, functioning with an independent broker can assist.

When you've determined that degree term is ideal for you, the following step is to purchase your policy. Below's how to do it. Determine just how much life insurance policy you need Your protection amount must attend to your family's long-term financial requirements, consisting of the loss of your earnings in the occasion of your death, along with financial debts and daily expenditures.

A degree costs term life insurance policy plan lets you stay with your budget while you assist protect your family members. Unlike some stepped price strategies that raises each year with your age, this type of term strategy offers prices that stay the exact same for the period you pick, even as you get older or your health changes.

Discover more concerning the Life insurance policy alternatives readily available to you as an AICPA member. ___ Aon Insurance Coverage Services is the trademark name for the brokerage and program management procedures of Fondness Insurance policy Services, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Firm, Inc. (CA 0795465); in Alright, AIS Fondness Insurance Solutions Inc.; in CA, Aon Fondness Insurance Services, Inc.

Specialist The Combination Of Whole Life And Term Insurance Is Referred To As A Family Income Policy

The Strategy Representative of the AICPA Insurance Policy Trust, Aon Insurance Coverage Providers, is not associated with Prudential. Team Insurance coverage is released by The Prudential Insurance Policy Business of America, a Prudential Financial business, Newark, NJ. 1043476-00002-00.

Latest Posts

Burial Insurance For Seniors Over 60

Out Insurance Funeral Cover

Best Burial Insurance For Seniors Over 70